What is a GST enabled invoice?

If your business income is below Rs20 Lakh then you are not supposed to worry about creating and managing a GST invoice. However, if the business income comes under the ambit of GST, then you are supposed to create a GST enabled invoice and manage it for getting timely payment and to comply with the GST filing every month with the government of India.

What are the different fields in a GST Invoice?

A standard GST enabled invoice consists of the following fields:-

1. Name of the client

2. Name of the supplier

3. Invoice issue date

4. Type of the Invoice

5. HSN or SAC Code number

6. Quantity

7. Price

8. GST Details

9. Invoice Number

These are the mandatory fields for GST enabled invoice.

Software available in the market?

There are many paid and free software available in the market that provide the facility of making a GST invoice. However, most of them only deal with creating an invoice. The creation of a GST enabled invoice is just one step. Another step is to send it to the client to get the timely payment, or to send reminders in case payment is not received, and finally, a system to record all these output GST entries to do timely filing at the end of the month. So for all these tasks, a free and very easy-to-use software is available in the market which is called as Invoicetra.

How to create a GST invoice from Invoicetra?

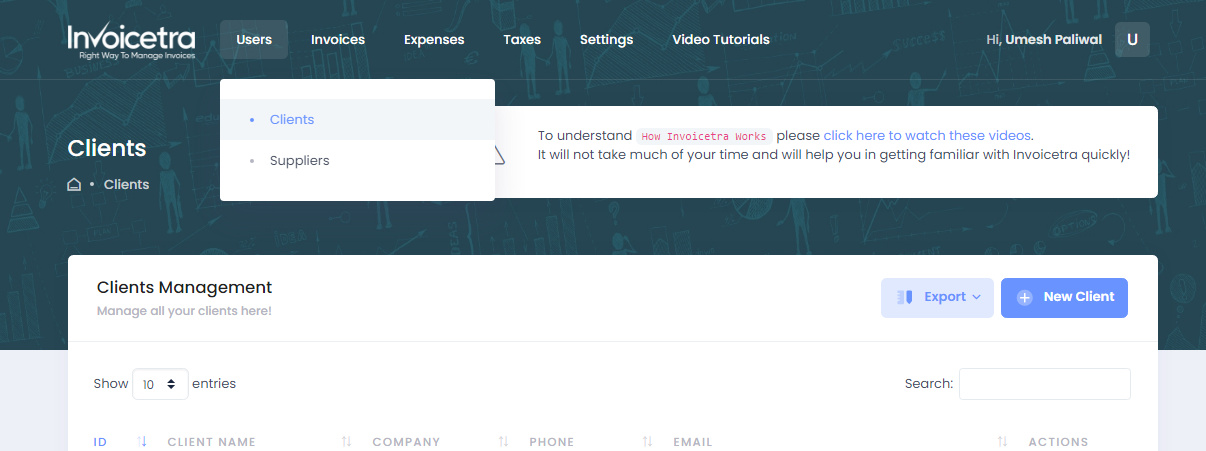

Step1: Go to Users and click on Client

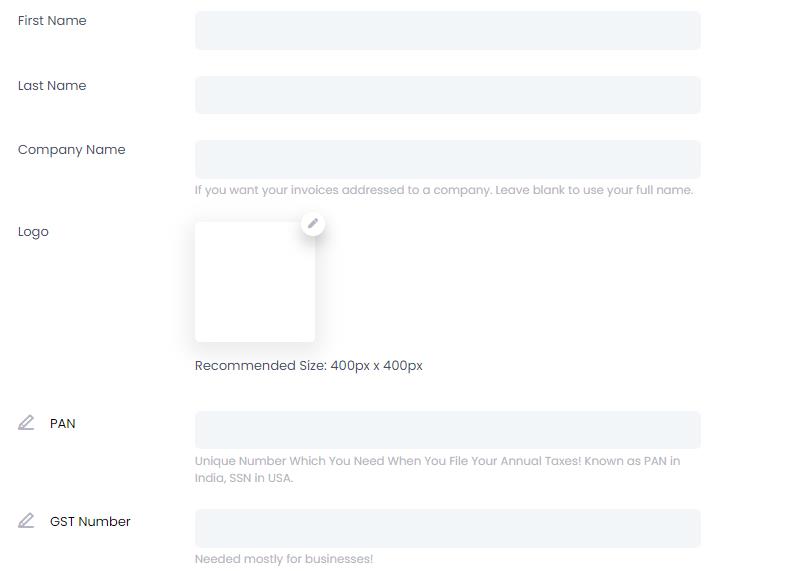

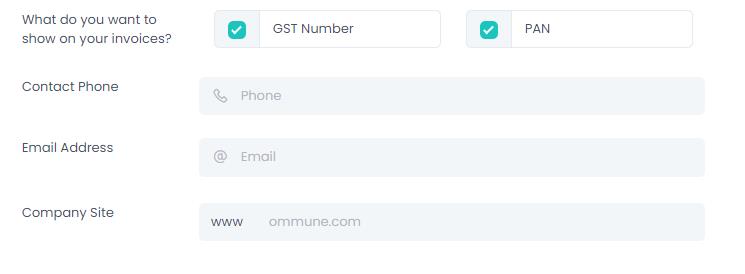

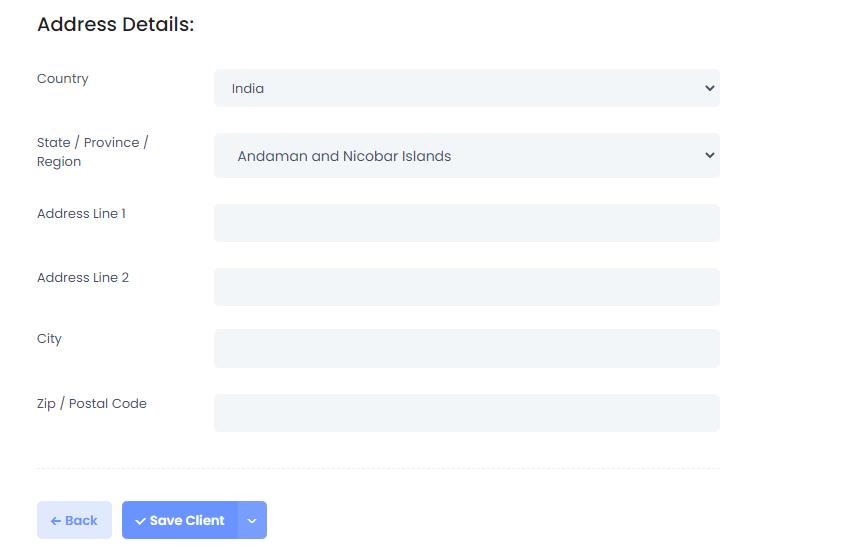

Step 2: Create a Client

Enter all the details of the Client Like Name, PAN, GST, Address, and save it.

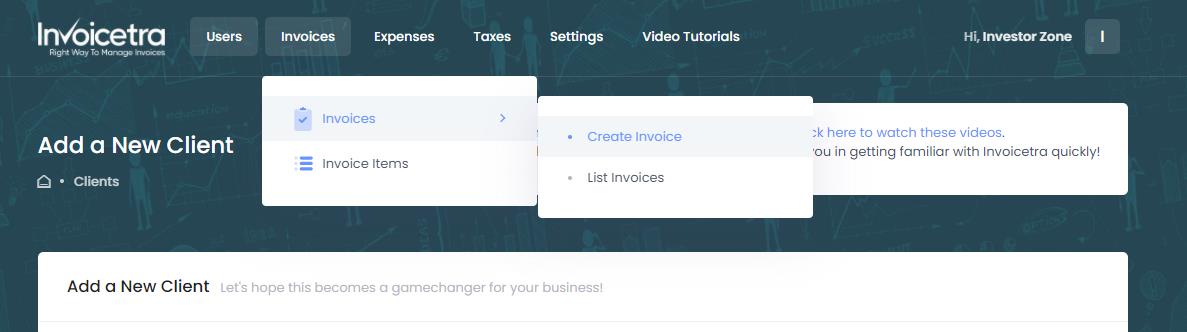

Step 3: Go to Invoices tab and click on create invoices

Step 4: Create an invoice

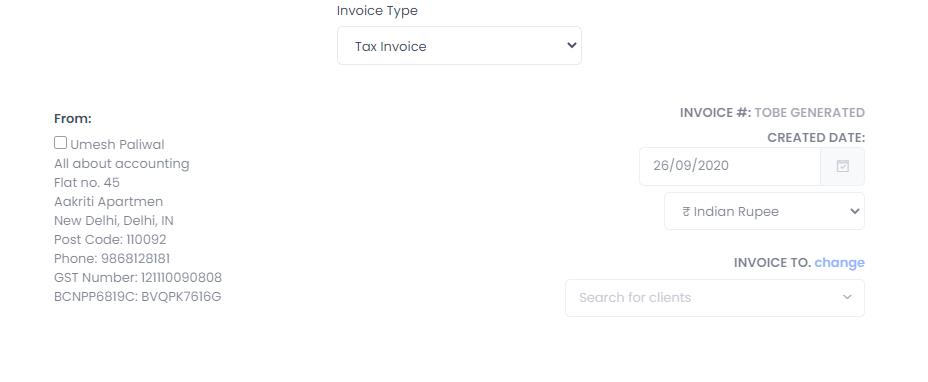

We will explain to you how to create a GST invoice in less than 60 seconds in Invoicetra. We divide the online invoice generation step into three parts.

Part 1:

Here, “From” field is already selected, i.e the name of the supplier who is generating an invoice. As a user, just select the type of invoice, date, currency on which invoice is created, and the name of the client.

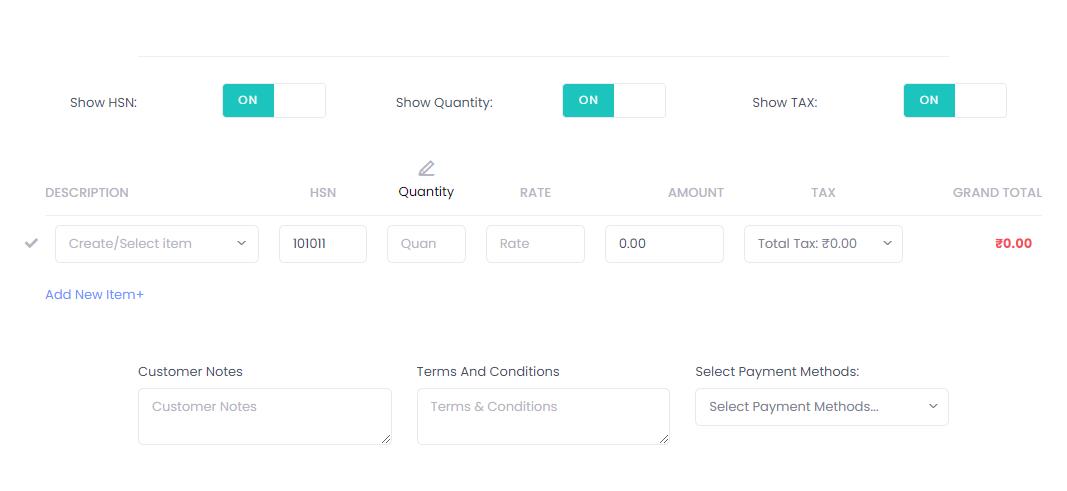

Part 2:

Part 3:

Part 2 is customizable and Part 3 will give you an option to select the due date. Also, it will show the total tax and total amount payable. Let us discuss Part 2 and Part 3.

Let us discuss Part 2 case by case.

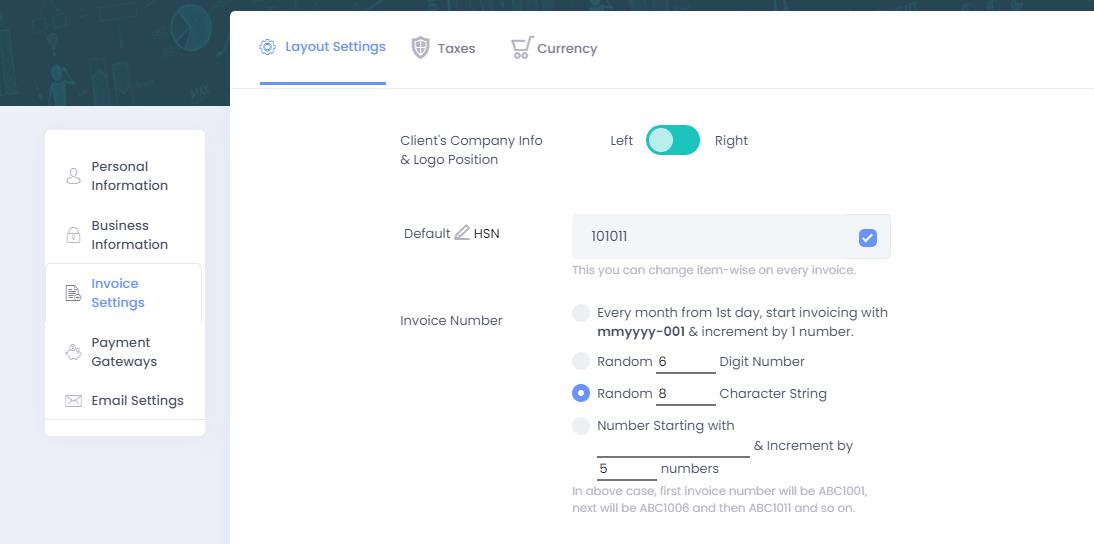

Case 1: The Goods provider falls under the ambit of GST.

Go to the Invoice settings, select HSN code, and from taxes select the rate of GST to be applied to the goods that you are selling.

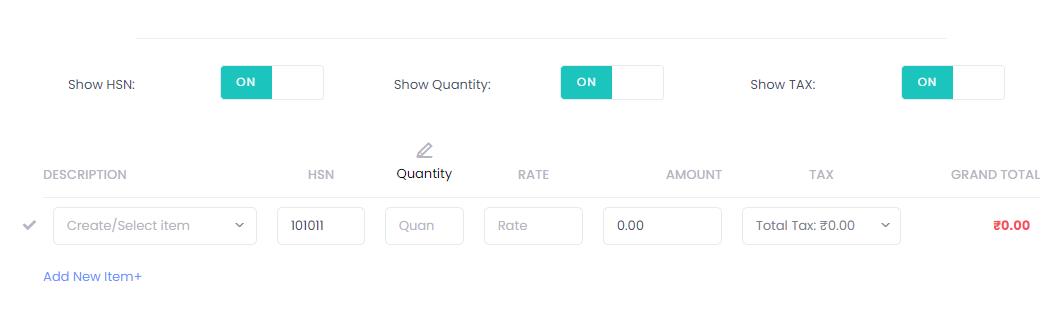

Then come to Part 2 of the Invoice generation.Enable -HSN, Quantity, and Tax button.

Put the item under description, HSN code will come automatically, add quantity, rate of selling, and select the tax to be applied.

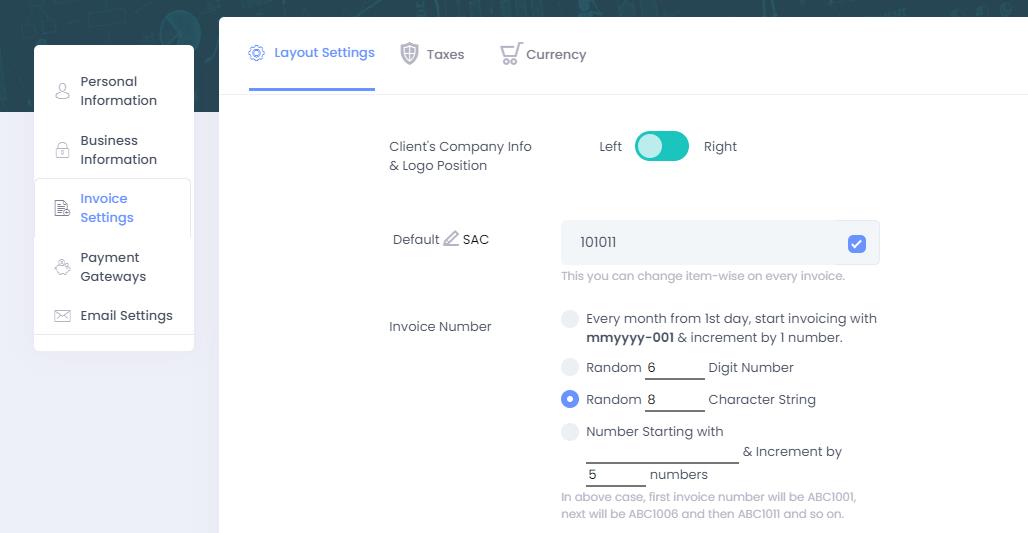

Case 2: The Service provider falls under the ambit of GST.

Go to the Invoice setting, select SAC code, and from taxes select the rate of GST to be applied to the service that you are selling.

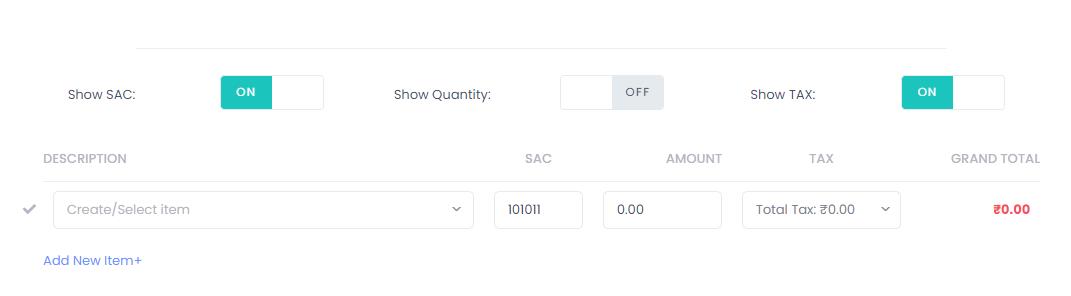

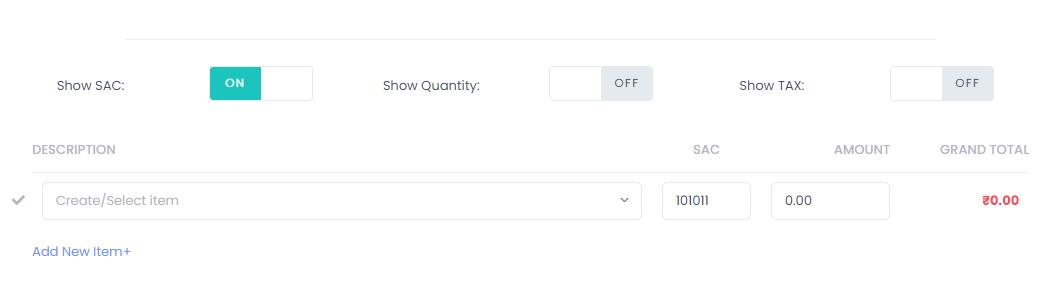

Then come to the Part 2 of the Invoice generation. Enable -SAC, and Tax button. Now as you are a service provider, Disable – Show Quantity. So, once you do that, the invoice will appear like this.

Put the item under description, SAC code will come automatically, add the amount, and select the tax to be applied.

Case 3: Business does not fall under scope of GST

If your business does not fall under the ambit of GST, you can disable the tax field and then create an invoice.

Now, simply input the item name and SAC/HSN Code will appear automatically.Then, select the corresponding amount.

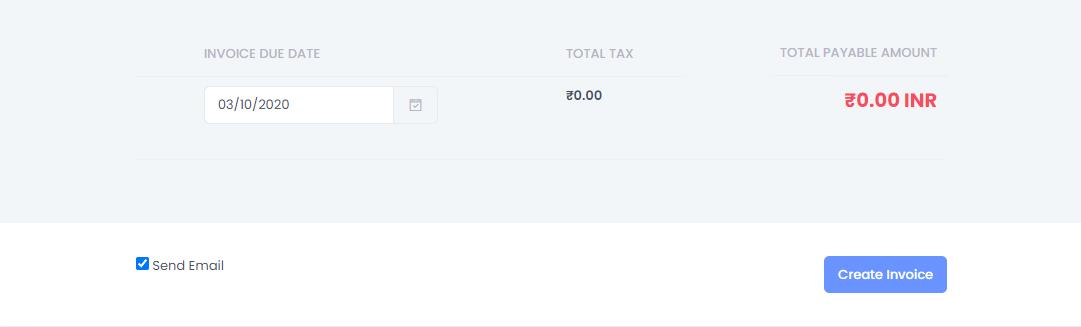

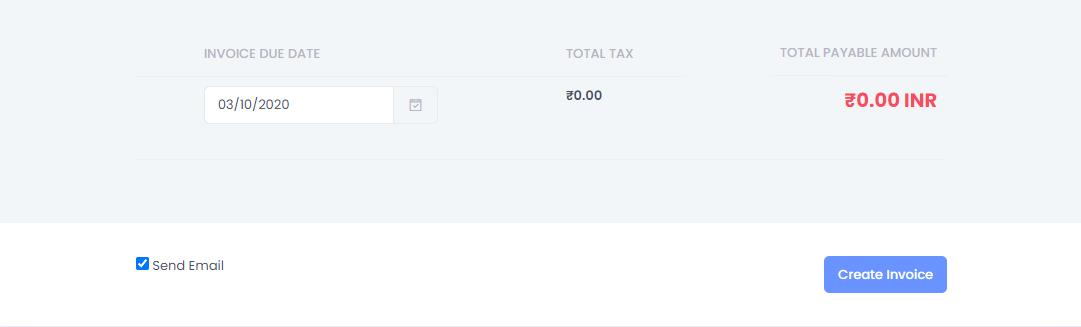

Part 3 is the final creation of the invoice and its despatch to the client via email.

After completing Part 1 and Part 2 of the online invoice generation, Part 3 will allow you to first set the due date of the Invoice- the date before which you want to get the payment, and it will show the total taxes and final amount of the Invoice. Once you are done customizing an Invoice, click on create Invoice and select “send email”. This will trigger an email to the client email id, informing an invoice has been created.

Note: Once the Invoice is created, the system will automatically make an entry in Output GST which will be used for filing a GST return every month.